Our own

manuelita otero

There’s something special about your own place. Buying your own home is an exciting step, it gives a certain type of security and comfort that is difficult to explain. As fulfilling as it is, it’s not an easy task and it takes time. It doesn’t matter what season in life you may be in, if you have owned many homes or if all you can afford right now is the dream of having your own place, we all want the feeling of owning our own home. At this moment in our family there’s a lot of talk about this topic because we would really, really, really like to own a house. We love our apartment, but it is time to stop paying rent and invest in our own space.

As exciting as buying a house may sound, not everything is peachy and reading, learning, preparing before making any moves is the way to go, so here are some general things we have been reading about. If you are searching for a home, we hope they help, if you already bought your own place and lived through the experience, please comment and share!

First things first. You don’t have to be a certain age or in a specific situation to buy a house. You can start planning as soon as you want and start saving as soon as you can. Be wise with your financial decisions early on, and develop healthy financial habits.

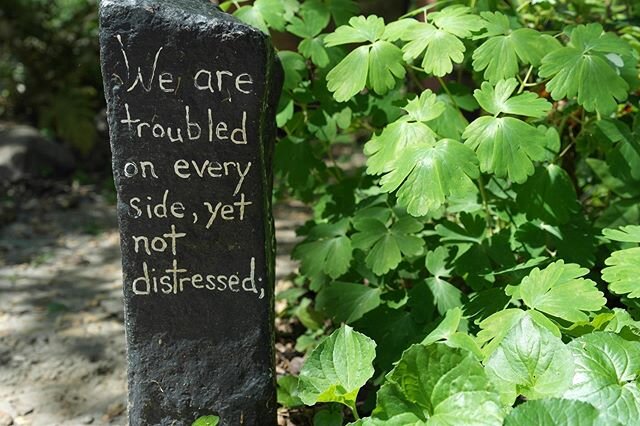

Owning a house comes with a huge responsibility and a long term commitment, so don’t take it lightly. Of course it doesn’t mean that you have to live there all your life, but you are responsible for it, so keep that in mind.

Be realistic with how much house you can buy. Look at the money you make each month and define a budget that considers all of your expenses. See how much can you really afford, and take into consideration insurance, administration, upkeep, and maintenance. Make a fund for those “unexpected extras” so they won’t surprise you.

Get rid of debt. That is the best thing you can do whether you are thinking to buy a house or not. Debt is a heavy weight to carry and the sooner you get out of it or better yet, the sooner you don’t get into, the better.

Give yourself a timeline and make it realistic so you can actually enjoy the process.

Check several neighborhoods, visit them at different times of the day, early during rush hour, midday, late at night. Have a feel of the place, walk around it, see who your neighbors would be. Take time to do the research.

Think first about what you love, what are the “musts” and the “nice to haves” Then, think about the things that would help you sell your place in case you need to sell. It is good to keep in mind that this may not be the place you will live in all your life, so things like great schools, access to walkable areas, safety and other things are appealing to buyers, but first think about you, because you want to live in a place you love.

Don’t get a 30 year loan, it may seem that you are paying less, but in reality the cost is much higher. Get a 15 year loan and the higher the down payment the better.

Keep in mind closing costs, which are around 3-4% of the cost of your house.

Once you get your house, don’t get swept away by the desire to decorate it. Again, make a budget and follow it. Decorate slowly, room by room if you have to, as long as you don’t get in debt.

Listen to other people’s experiences and learn from them!